Get the free transfer on death deed montana form

Show details

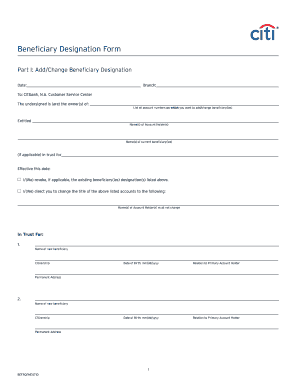

Return Document to Name Mailing Address City State Zip Beneficiary Deed I We Owner hereby convey to Grantee Beneficiary effective on my our death the following described real property Legal description from previously recorded deed If a grantee beneficiary predeceases the owner the conveyance to that grantee beneficiary must either choose one Become part of the estate of the grantee beneficiary Become void Date Signature of Grantor s State of Montana County of This instrument was signed...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your transfer on death deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer on death deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer on death deed montana online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit montana beneficiary deed form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

How to fill out transfer on death deed

How to fill out a transfer on death deed?

01

First, obtain a transfer on death deed form from your state's real estate or probate office. This form is usually available online or at the office itself.

02

Fill in your personal information as the grantor, including your name, address, and contact details.

03

Identify the property being transferred by providing its legal description or address.

04

Name the beneficiaries who will receive the property upon your death. Include their full names, addresses, and any specific instructions for distribution if desired.

05

Specify the conditions under which the transfer on death deed will take effect. This typically includes stating that the transfer will only occur upon your death and cannot be revoked during your lifetime.

06

Sign and date the transfer on death deed in the presence of a notary public. Some states may require additional witnesses.

07

Record the completed deed with the appropriate county or state agency responsible for maintaining real estate records. There is usually a fee associated with recording the deed.

Who needs a transfer on death deed?

01

Individuals who wish to control the transfer of their real estate to specific beneficiaries upon their death may consider a transfer on death deed.

02

This option is particularly useful for individuals who want to avoid probate and simplify the transfer process for their loved ones.

03

Transfer on death deeds may also be beneficial for those who do not want to establish a living trust or go through the complexities of creating a will.

Fill montana tod deed : Try Risk Free

People Also Ask about transfer on death deed montana

What is a transfer on death statute in Montana?

What are the disadvantages of a transfer on death deed?

What are the drawbacks of a TOD?

Does Montana have a transfer on death deed?

Does Montana have a beneficiary deed?

Is transfer on death a good idea?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is transfer on death deed?

A transfer on death deed (TODD) is a legal document that allows a person to transfer ownership of real property to another person after death. This type of deed is also known as a beneficiary deed or a revocable transfer on death deed. A TODD allows a person to transfer property without going through the probate process. The TODD must be properly executed and filed with the county recorder in order to be effective.

How to fill out transfer on death deed?

1. Fill out the necessary information on the deed:

• The names and addresses of the grantor and the beneficiaries

• The legal description of the property

• The type of deed (e.g., transfer on death)

• A statement that the deed is revocable

2. Have the deed signed by the grantor and witnessed by two people.

3. Have the deed recorded at the local county recorder’s office.

4. Give a copy of the recorded deed to all the beneficiaries.

When is the deadline to file transfer on death deed in 2023?

The exact deadline to file a transfer on death deed in 2023 varies from state to state. Generally, transfer on death deeds must be filed prior to the death of the owner. Therefore, it is best to consult with a qualified estate planning attorney who is familiar with the laws in your state.

What is the penalty for the late filing of transfer on death deed?

The specific penalty for filing a transfer on death deed late will vary by jurisdiction. Generally, though, late filing may result in additional fees or taxes, or the transfer may be denied altogether.

Who is required to file transfer on death deed?

The person required to file a transfer on death deed is the property owner, also known as the grantor. They must prepare and execute the transfer on death deed, and file it with the appropriate county office where the property is located.

What is the purpose of transfer on death deed?

The purpose of a transfer on death deed (TOD deed) is to allow an individual to transfer ownership of real property to a designated beneficiary upon their death, without the need for probate. This type of deed allows the individual to retain their property rights during their lifetime but ensures a smooth transfer of the property to the beneficiary without the need for a will or the probate process. It can be an effective estate planning tool for individuals who wish to pass their property directly to their chosen beneficiary.

What information must be reported on transfer on death deed?

The specific information that must be reported on a transfer on death deed may vary depending on the jurisdiction, but generally, the following information is required:

1. The names and contact information of the grantor (owner of the property) and the beneficiary (person who will receive the property upon the grantor's death).

2. A clear description of the property being transferred, including the address and legal description.

3. The effective date of the transfer, which is typically the grantor's death.

4. Any specific conditions or limitations for the transfer, if applicable.

5. The grantor's signature and acknowledgement of the transfer in the presence of a notary public or other authorized person.

6. Any additional information or requirements necessary under local laws or regulations.

It is important to consult the specific laws and regulations of the jurisdiction where the transfer on death deed is being executed, as the requirements can vary greatly between different states or countries.

How can I edit transfer on death deed montana from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your montana beneficiary deed form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute montana transfer on death deed online?

pdfFiller has made filling out and eSigning montana beneficiary deed form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I edit beneficiary deed montana on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing montana transfer on death deed form right away.

Fill out your transfer on death deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Montana Transfer On Death Deed is not the form you're looking for?Search for another form here.

Keywords relevant to transfer on death deed form montana

Related to beneficiary deed montana form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.